Best Suggestions For Picking Fx Trading Websites

Wiki Article

Top 10 Tips For Choosing A Broker When You Are Considering Trading Forex Online

It is vital to select the most reliable Forex broker as it directly impacts your trading performance along with your overall experience and security. Here are 10 important guidelines for choosing the best Forex broker.

Review the Reputation and Status of the Organization.

1. Make sure you choose brokers that are licensed and monitored by respected regulatory bodies, like the U.S. CFTC. UK FCA. Australian ASIC. or EU CySEC. Regulation ensures the brokers you select follow the standards of their industry. Additionally, you are protected from scams and your money are safe. Avoid brokers who aren't regulated or who have faced problems in the past.

2. Costs of trading (Spreads and Commissions).

Brokers earn their income through commissions or by spreading (the gap between the prices of buying and selling). It is important to look for brokers that offer affordable, transparent fees. For example, a brokerage with a tight spread on major currency pairs could be more economical when you trade regularly. Be aware of hidden costs like inactivity fees or excessive withdrawal fees.

3. Check out the variety of currency pairs offered

If your strategy requires it, make sure the broker you select has various currency pairs. These should include both major pairs such as EUR/USD along with minor or exotic ones. With a larger selection it is possible to trade according to market conditions and diversify.

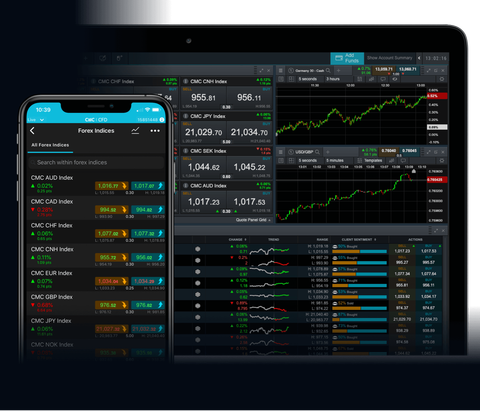

4. Trading Platform and Tools - Examined

Trading platforms serve as your primary means of interacting with the markets. They should be reliable and intuitive with tools that match your trading style. Numerous brokers offer platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or even proprietary software. Before you decide to invest ensure that you explore all the features that are available on the platform. This includes charting tools, indicators, and speed of order execution.

5. Check the account types and leverage options.

Brokers provide a range of account types, which differ in regards to spreads, leverage and minimum deposits. Select a broker that provides an account type that is suitable for your budget, trading style and experience. If you're just beginning to learn about trading, stay away from brokers who offer very high leverage. They can result in large losses.

Review your Deposit and Withdrawal Options

Review the processing times as well as the fees and deposit/withdrawal options available. A reliable broker will offer convenient, secure, and low-cost options, such as bank transfers, credit cards or trusted e-wallets such as copyright or Skrill. Beware of companies that offer lengthy processing times or high fees for withdrawals.

7. Test Customer Support Responsiveness

It is crucial to have a reliable and trustworthy customer service, especially in the case of urgent issues such as withdrawal problems or platform malfunctions. The customer service is tested through contacting the broker using various channels. Find brokers that offer 24/7 support if you trade during non-business hours.

8. Security Measures to Protect Funds

You can be sure that your funds will be secured when you work with an established brokerage. Check if the broker keeps client funds in segregated accounts (separate from the broker's operational funds) and also offers negative balance protection which stops you from losing more than the balance of your account. These steps can help ensure your cash is safe from broker bankruptcy or volatile market conditions.

9. Look for resources that can help you learn and develop as a novice.

The brokers will offer you educational materials including webinars, tutorials on trading, market research, and demos. These resources are invaluable particularly if you wish to improve your Forex trading abilities or when you're making your first attempt. Demo accounts allow you to test your skills without putting any money on the line. This is a great opportunity to get started.

10. Read Independent Reviews or Ask for recommendations

Reviews can help you understand the strengths and weaknesses of a broker and hidden costs. Examine reviews from reputable review sites, forums, and trading communities. Be aware of fake or promotional reviews. Expert traders can help you make the right decision.

Selecting the best Forex broker requires careful consideration of a variety of factors. To determine which broker best suits your trading needs it is important to consider transparency and regulatory compliance as well as general trading conditions. Read the top https://th.roboforex.com/ for website recommendations including broker cfd, foreign exchange trading platform, app forex trading, fx forex trading, top forex trading apps, broker trading, forex trading demo account, brokers for forex in usa, forex brokers usa, platform for trading forex and more.

Ten Ways To Prepare Yourself Mentally Prior To Trading Forex On The Internet.

Forex trading is a highly emotional activity. Mental resiliency and control of emotions are crucial aspects in making the right decisions. Here are 10 top tips for developing a positive attitude to trading forex online: 1.

Control and recognize emotions

1. Trading can trigger strong emotions, such as fear, greed, frustration even joy. Understanding these emotions is the first step in controlling them. Remain calm, particularly when you lose or win since emotions can lead you to make impulsive choices. Consistency is a result of disciplined trading.

2. Accept that Losses are Part of Trading

Losses are inevitable for all traders. The acceptance of losses during the learning and trading process can lessen the emotional strain. Examine your performance over time instead only focusing on the outcome. This can help you overcome backslides while moving forward.

3. Be realistic with your expectations

The Forex market isn't a quick-fix scheme to get rich. Beginners tend to set unrealistic expectations, such as increasing their accounts by the shortest amount of time that can lead them to take unnecessary risks. Set reasonable and achievable goals that are based on your amount of experience, capital and the time you'll need to put in. This will help you stay on the right track and helps avoid disappointment.

4. Trade according to your plan

A trading plan defines your strategy as well as your risk tolerance and trading guidelines. It will guide you through various market conditions. Being on the right track by following your plan for trading prevents you from making unintentional and irrational decisions. It also helps to keep you on track, since it stops you from taking impulsive actions.

5. Develop discipline and practice patience.

It is important to be patient when finding the best trading opportunities instead of forcing trades out of boredom or impatience. Follow your plan with discipline, even when you're inclined to stray from it. Remember that the quality of your trades are what will determine whether you are a successful trader.

6. Stress Management through Healthy Habits and Healthy Habits

To maintain mental peace, stress management is crucial. To maintain a healthy outlook, maintain good habits including exercising, sleeping, and taking breaks. Stress can impair your judgment, so ensure you take care of yourself so that you keep your focus and focus.

7. Separate trading from personal life

Don't let personal issues or stress influence your trading. It is essential to maintain an open mind and keep your yourself from your trading perspective. Set limits and stay away from trading during times of high personal stress, as this can lead to emotional-driven decisions.

8. Avoid retribution Trading

It's not uncommon to find yourself in a rush to recover from a loss by making a new trade. The process of "revenge trading" often leads to more impulsive decisions and bigger losses. If you've lost money, take a break, examine the reasons for the loss and then wait for the next opportunity that is well-planned.

9. Learn to be flexible and adaptable

Even the most effective strategies can't be 100% guaranteed to succeed. The market conditions are always changing. Be prepared mentally to change and evolve your approach, instead of relying on one method, boosts your resilience. Flexibility allows you to be able to avoid disappointment and accept changes as an inevitable part of your growth.

10. Keep an Trading Journal and Reflect

Keeping a trading journal with specifics regarding each trade, as well as the decision-making process and emotions, can help you spot patterns in your actions. A regular review of your trading journal will allow you to identify any emotional triggers, help you improve the strategies you employ and improve your mental capacity.

When it comes to Forex trading, the proper psychological preparedness often separates successful traders from those who struggle. By improving your decision-making and strengthening your resistance to market changes You can develop your emotional control, patience, or discipline. Have a look at the best for site examples including forex brokers usa, forex trading, broker trading, best forex brokers, best forex trading broker, best rated forex brokers, forex broker platform, fx online trading, forex trading forex trading, fbs broker review and more.

When Considering Online Forex Trading Here Are 10 Helpful Tips To Help You Build Your Skills And Learn The Basics Of Trading.

Demo accounts are an excellent method to improve your trading skills and gain confidence before trading real money. These are the top 10 suggestions for maximizing your experience with demo trading and enhancing your knowledge in Forex trading:1.

Treat Your Demo Account Like a Real Account

1. If you're looking to make the most benefit from demo trading, then treat it with the seriousness as you would with a real account. Set up risk limits and make trades as if you had real money at stake. This will help you build good habits that you can carry over into live trading.

2. Create and test a Trading Plan

Make use of the demo account to develop a solid trading plan. It should contain Entry and Exit Strategies and Risk Management Rules and Position Sizing. Test your plan rigorously over different market conditions and trades. The strategy can be modified in response to the outcomes. This will help create a more stable strategy.

3. Learn How To Use The Trading Platform

Familiarize yourselves with all features of your trading platforms that include charting orders, the types of orders, risk management, as well as other settings. This will boost your efficiency and confidence, decreasing the possibility of making a mistake when you move to live trading.

4. Different Trading Strategies

Demo accounts are a fantastic method to experiment with different strategies and find out what you like. It is possible to experiment with various strategies to find their strengths, weaknesses and compatibility.

5. Techniques for managing risk

You can make use of the demo account of your choice to learn how to establish stop-losses and leverage, and determine the appropriate size of positions. Risk management is crucial to long-term financial success. Therefore, you should be practicing it until it is routine.

6. Track your trades and analyze them. your transactions and track

Keep a comprehensive journal of your trading activities where you document every trade, along with the reasons for entry and exit as well as the results of trades as well as any emotions you experienced in the course of trading. You can refine your trading plan by frequently reading your journal.

7. Simulate Market Conditions

Try to simulate the type of trades that you'll be making as well as the leverage you use and the size of your position in a real account. Avoid trading with large amounts or in unrealistic ways. They won't accurately reflect the actual circumstances that you will face when trading with your funds.

8. Test yourself under different market conditions

The Forex market is different under various conditions (trending fluctuating, ranging or calm). Try your demo to evaluate your strategies in different situations such as news events with high impact or periods of low volatility. You will be better prepared to deal with different situations when trading live.

9. Gradually increase complexity

Before adding advanced tools or timeframes start with simple strategies or indicators. As you gain confidence, you'll be able to build your skills and familiarity with more advanced techniques. This step-by-step method will help you understand the fundamentals of strategy prior to tackling complex strategies.

10. Set a Time Limit for Demo Trading

Demo trading can be extremely useful, but don't spend long periods of time on it. Once you're consistently profitable and confident with your approach, think about moving to a live trading account using the smallest amount. Demo trading isn't a good way to simulate the emotions and psychological aspects of real-world trading. So, transition only when you are ready.

By following these tips you will get the most of your experience with demo trading. You'll develop efficient trading techniques and build the foundation to be successful in the future. Be consistent, have discipline, and keep an eye for continuous improvements. Read the recommended https://th.roboforex.com/about/client/security-policy/ for blog advice including currency trading platforms, forex trading strategies, fx online trading, best currency trading app, fx trading platform, best currency trading app, fbs review, forex and trading, best broker for currency trading, best forex trading platform and more.